- Home

- |

- Credit Cards

- |

- Credit Line Increase

Credit limit increase service for Citi Credit Card

- Greater financial flexibility in your daily needs

- Maximize the benefits of your Citibank Credit Card(s)

- Instant temporary credit line increase with no documents required

Credit line is the maximum balance that the bank agrees for customers to borrow in advance. Customers can draw down the credit line at anytime, for any amount as long as it doesn't exceed the maximum credit line.

Apply for permanent credit limit increase

Get a permanent credit line increase and enjoy greater financial freedom! You can permanently maximise the benefits of Citibank Ready Credit, Cash Advance, Click for Cash or Citibank PayLite for extra spending and making large purchases more efficient with a higher credit limit permissible to your monthly income bracket, as per Bank of Thailand regulations. Simply submit your new incremental income documents to get a higher permanent credit line.

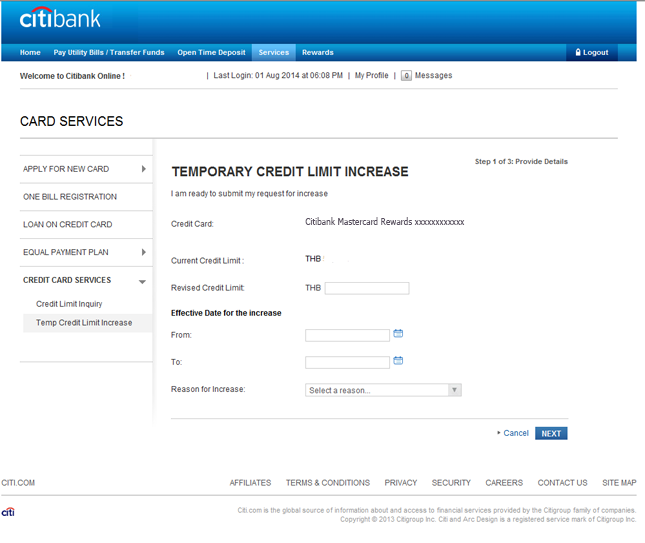

Apply for temporary credit limit increase

Citibank understands your urgent needs of credit and we are here to offer you an instant temporary credit line increase without any documents via Citibank Online. A temporary credit line increase allows you to have more credit in times of emergency, extra cash for spending during travel or even to make large last-minute purchases more efficiently through Citibank PayLite and Click for Cash.

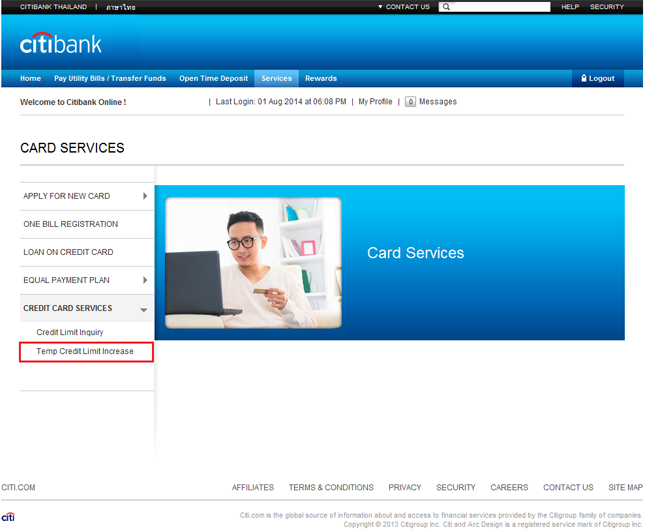

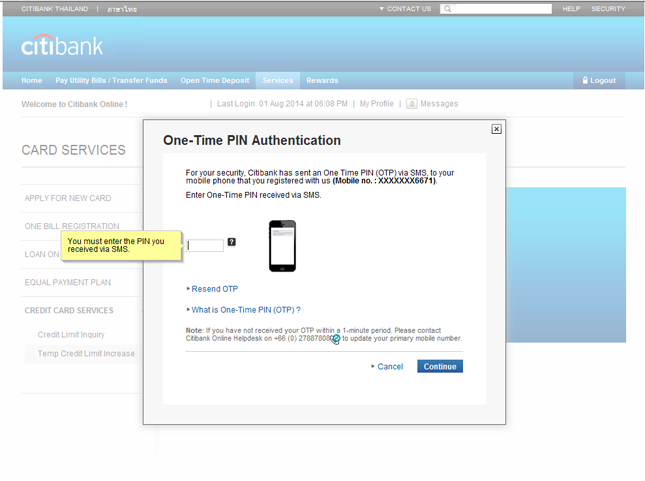

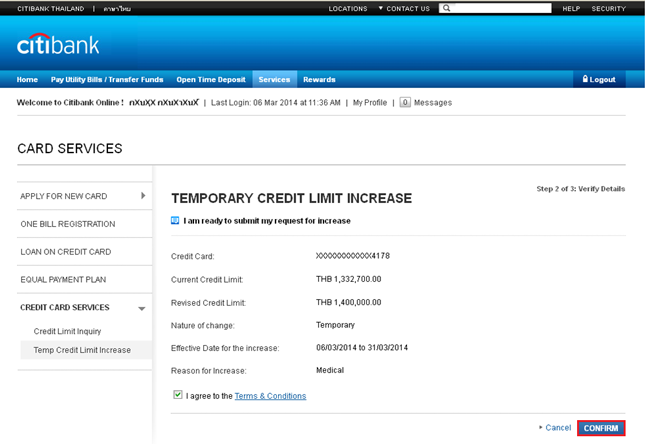

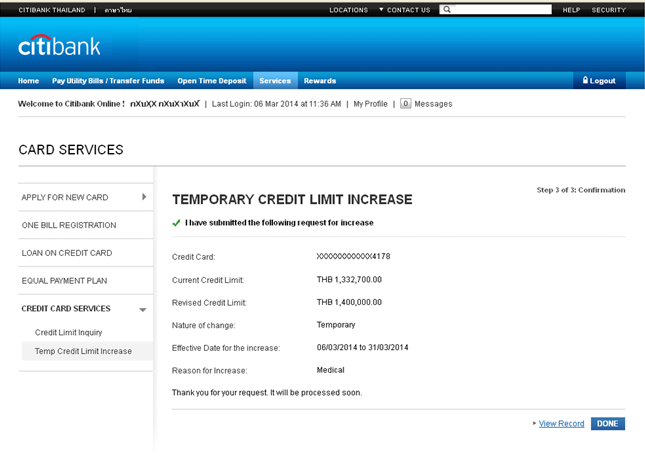

Steps to apply for temporary credit limit increase:

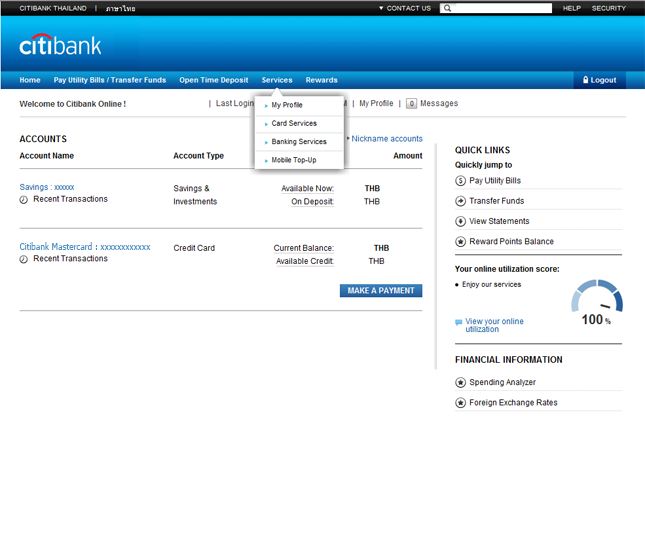

Login to Citibank Online using UserID & Password.

ELIGIBILITY

- The request must be done on primary card

- Time interval between temporary credit line increases is at least 30 days

- Maximum number of temporary credit line requests is 4 times in the last 12 months

- Currently not using a temporary credit line increase

- The credit line allowance request is based on the history of your credit card and the documents that you submit. The new credit line will depend on the internal criteria of Citibank.

- New increment credit line will be within the permissible bracket of monthly income, as per Bank of Thailand regulations.

- Maximum temporary line validity is up to 2 cycles.

- Citibank would like to inform you that, in accordance with Citibank’s privacy policy, Citibank do not wish to collect sensitive personal data on the copy of your ID card, such as religion and blood type data. Therefore, Citibank encourages you to blind or cross out such sensitive personal data before delivering the document to Citibank. If after receiving a copy of your ID card, the document still contains the sensitive personal data, Citibank is requesting for your permission to blind or cross such sensitive personal data out from the document, in accordance with the privacy policy and principles of personal data collection under the personal data protection law only.